UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12 |

PHIO PHARMACEUTICALS CORP.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | Fee not required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration State No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

257 Simarano Drive, Suite 101

Marlborough, MA 01752

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS

To Be Held on , 2019

JUNE 15, 2021

Dear Stockholder:

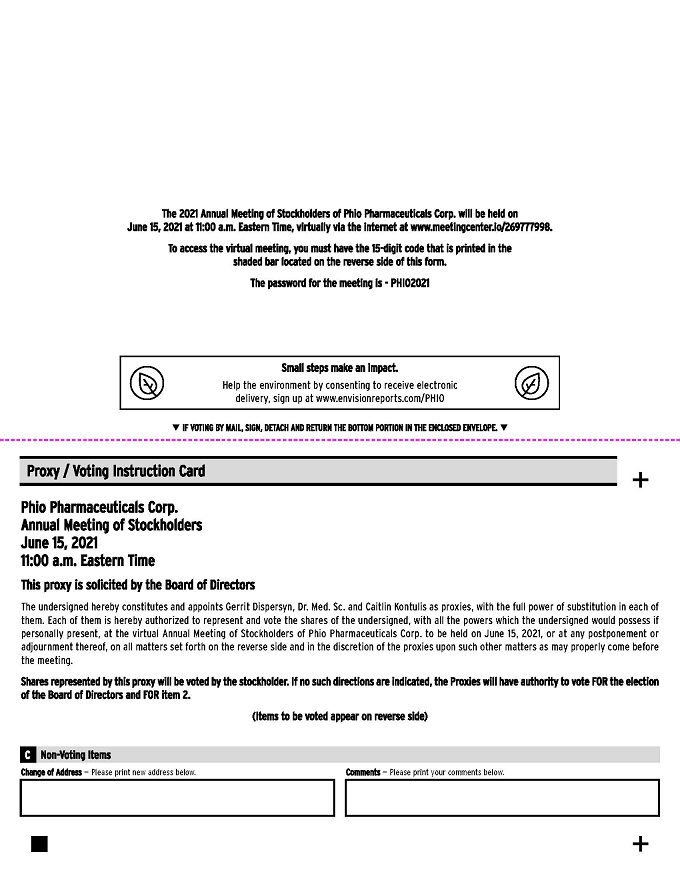

You are cordially invited to attend the special meeting2021 Annual Meeting of stockholdersStockholders (the “SpecialAnnual Meeting”) of Phio Pharmaceuticals Corp., a Delaware corporation (the “Company”), which will be held on , 2019,June 15, 2021, at 9:11:00 a.m. local time, at(Eastern Time). The meeting will be a completely virtual meeting of stockholders. You can attend the offices ofmeeting by visiting www.meetingcenter.io/269777998 where you will be able to listen to the Company, located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752. meeting live, submit questions, view the stockholder list, and vote online. The password for the meeting is PHIO2021. Because the meeting is completely virtual and being conducted via the internet, stockholders will not be able to attend the meeting in person physically.

Only stockholders who held stock at the close of business on the record date, , 2019,April 16, 2021, may vote at the SpecialAnnual Meeting, including any adjournment or postponement thereof. If you wish to attend the Special Meeting in person, you must RSVP by marking the appropriate box on the proxy card or by contacting the Company by , 2019 by telephone at 508-767-3861. In order to be admitted into the Special Meeting, your name must appear on the attendance list and you must present government-issued photo identification (such as a driver’s license).

At the SpecialAnnual Meeting, you will be asked to consider and vote upon:

| (1) |

| (2) | the |

The accompanying Proxy Statement more fully describes the details of the business to be conducted at the SpecialAnnual Meeting. After careful consideration, our Board of Directors has unanimously approved the proposalproposals and recommends that you vote FOR theeach nominee and proposal described in the Proxy Statement.

We are pleased to make use of the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders via the Internet. We believe the ability to deliver proxy materials electronically allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact from the distribution of our Annual Meeting materials.

We look forward to seeing you at the SpecialAnnual Meeting.

| Sincerely, | |

| |

| Gerrit Dispersyn, Dr. Med. Sc. | |

| President and Chief Executive Officer |

, 2019

April 30, 2021

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE VIA THE INTERNET OR OVER THE TELEPHONE AS INSTRUCTED IN THE ENCLOSEDNOTICE REGARDING THE AVAILABILITY OF PROXY STATEMENTMATERIALS AND ON THE ENCLOSED PROXY CARD.CARD OR, IF YOU REQUESTED AND RECEIVED A PRINTED COPY OF THE PROXY STATEMENT, COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD USING THE ENCLOSED RETURN ENVELOPE, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSONAT THE MEETING IF YOU ATTEND THE MEETING.MEETING VIRTUALLY. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY CARD ISSUED IN YOUR NAME FROM THAT INTERMEDIARY.

257 Simarano Drive, Suite 101

Marlborough, MA 01752

PROXY STATEMENT FOR

2019 SPECIAL2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2019JUNE 15, 2021

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Phio Pharmaceuticals Corp. (“Phio” or the “Company”) for use at the special meetingCompany’s 2021 Annual Meeting of stockholdersStockholders (the “SpecialAnnual Meeting”), to be held.

The Company will hold the Annual Meeting virtually on Tuesday, June 15, 2021 at the offices of the Company, located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752 on , 2019, at 9:11:00 a.m. local time. This(Eastern Time). You can attend the Annual Meeting by visiting www.meetingcenter.io/269777998, where you will be able to listen to the meeting live, submit questions and vote online. To participate in the Annual Meeting, you will need the control number included on your Notice or proxy card and the password: PHIO2021. Because the Annual Meeting is completely virtual and being conducted via the internet, stockholders will not be able to attend the meeting in person physically.

The Company anticipates that the Notice Regarding the Availability of Proxy Materials (the “Notice”) in connection with this Proxy Statement is beingwill first be mailed to our stockholders will be on or about , 2019.May 6, 2021 to all stockholders entitled to vote at the Annual Meeting and we will post our proxy materials on the website referenced in the Notice.

The Notice instructs you as to how you may access and review important information contained in the proxy materials. The Notice also instructs you on how you may submit your proxy via the Internet. If you receive a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

For a proxy to be effective, it must be properly executed and received prior to the SpecialAnnual Meeting. Each proxy properly tendered will, unless otherwise directed by the stockholder, be voted for the proposals and nominees described in this Proxy Statement and at the discretion of the proxy holder(s) with regard to all other matters that may properly come before the meeting.

The Company will pay all of the costs of soliciting proxies and has engaged a proxy solicitor, Alliance Advisors, LLC, to assist in solicitation of proxies. WeIt is estimated that the total cost for the solicitation campaign will be approximately $10,000. In addition, we will provide copies of our proxy materials to brokerage firms, fiduciaries and custodians for forwarding to beneficial owners who request printed copies of these materials and will reimburse these persons for their costs of forwarding these materials. Our directors, officers and employees may also solicit proxies by telephone, facsimile or personal solicitation; however, we will not pay them additional compensation for any of these services.

Shares Outstanding and Voting Rights

Only holders of record of our Company’s common stock, par value $0.0001 per share (the “Common Stock”) at the close of business on , 2019April 16, 2021 (the “Record Date”), are entitled to notice of and to vote at the SpecialAnnual Meeting. On the Record Date, 13,534,389 shares of common stock were issued and outstanding. Each share of common stock is entitled to one vote on all matters to be voted upon at the SpecialAnnual Meeting. Holders of Common Stock do not have the right to cumulative voting in the election of directors. The presence, in person or by proxy, of the holders of a majorityat least one-third of the outstanding shares on the Record Date will constitute a quorum for the transaction of business at the SpecialAnnual Meeting and any adjournment thereof.

| 1 |

Persons who hold shares of our Common Stock directly on the Record Date (“record holders”) must return a proxy card or attend the SpecialAnnual Meeting in person virtually in order to vote on the proposal.proposals. Persons who hold shares of our Common Stock indirectly on the Record Date through a brokerage firm, bank or other financial institution (“beneficial holders”) must return a voting instruction form to have their shares voted on their behalf. Brokerage firms, banks or other financial institutions that do not receive voting instructions from beneficial holders may either vote these shares on behalf of the beneficial holders on certain “routine” matters or return a proxy leaving these shares un-voted (a “broker non-vote”).

Abstentions and broker non-votes (if any) will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast on a given proposal. The required vote for each of the proposalproposals expected to be acted upon at the SpecialAnnual Meeting is described below:

Proposal No. 1 — Approve an amendment to the Company’s Amended and Restated CertificateElection of Incorporation to effectdirectors. Directors are elected by a reverse stock split of the Company’s Common Stock, at a ratio of not less than and not greater than ,plurality, with the exact ratioseven nominees obtaining the most votes being elected. Because there is no minimum vote required, abstentions and effective timebroker non-votes (if any) will be entirely excluded from the vote and will have no effect on its outcome. Under the plurality vote standard, any shares that are not voted, whether by abstention, broker non-votes (if any) or otherwise, will not affect the election of the reverse stock split to be determined by the Boarddirectors.

Proposal No. 2 — Ratification of Directors (the “Reverse Stock Split”)independent registered public accounting firm. This proposal must be approved by a majority of the outstanding shares of our Common Stock.votes cast on the matter affirmatively or negatively. As a result, abstentions and broker non-votes (if any) will be entirely excluded from the vote and will have the sameno effect as a vote against such proposal.on its outcome.

We encourage you to vote by proxy, whether via telephone, through the Internet or mailing an executed proxy card. By voting in advance of the SpecialAnnual Meeting, this ensures that your shares will be voted and reduces the likelihood that the Company will be forced to incur additional expenses soliciting proxies for the SpecialAnnual Meeting. Any record holder of our Common Stock may attend the SpecialAnnual Meeting in person virtually and may revoke the enclosed form of proxy at any time by:

Beneficial holders of our Common Stock who wish to change or revoke their voting instructions should contact their brokerage firm, bank or other financial institution for information on how to do so. Beneficial holders who wish to attend the SpecialAnnual Meeting and vote in person virtually should contact their brokerage firm, bank or other financial institution holding shares of our Common Stock on their behalf in order to obtain a “legal proxy,” which will allow them to both attend the SpecialAnnual Meeting and vote in person.person virtually. Without a legal proxy, beneficial holders cannot vote at the SpecialAnnual Meeting because their brokerage firm, bank or other financial institution may have already voted (oror returned a broker non-vote)non-vote on their behalf.

Virtually Attending the Annual Meeting

You will be able to attend the Annual Meeting online, submit your questions during the meeting and vote your shares electronically at the meeting by visiting www.meetingcenter.io/269777998. Because the Annual Meeting is completely virtual and being conducted via the internet, stockholders will not be able to attend the meeting in person physically. However, we have designed the meeting to provide stockholders with the same rights and opportunities to participate as they would have at an in-person meeting. To participate in the Annual Meeting, you will need the control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is PHIO2021. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below. The Annual Meeting webcast will begin promptly at 11:00 a.m. (Eastern Time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:50 a.m. (Eastern Time), and you should allow ample time for the check-in procedures.

The virtual meeting platform is fully supported across Microsoft Edge, Firefox, Chrome and Safari browsers and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is no longer supported. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it or you may call 1-888-724-2416 or 1-781-575-2748.

| 2 |

PROPOSAL NO. 1

THE REVERSE STOCK SPLIT PROPOSAL

General

Our Board has unanimously approved, and recommended thatIf you are a registered shareholder (i.e. you hold your shares through our stockholders approve, an amendment to our Charter (the “transfer agent, Computershare Trust Company, N.A. (“Certificate of AmendmentComputershare”), you do not need to effect a reverse stock split at a ratio of not less than and not greater than (the “Reverse Stock Split”), withregister to attend the final decision of whether to proceed withAnnual Meeting virtually on the Reverse Stock Split,internet. Please follow the effective time ofinstructions on the Reverse Stock Split, and the exact ratio of the Reverse Stock Split to be determined by the Board, in its sole discretion and without further action by the stockholders.Notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the stockholders approveAnnual Meeting virtually on the Reverse Stock Split,internet. To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Company holdings along with your name and the Board decidesemail address to implement it, the Reverse Stock Split will become effectiveComputershare. Requests for registration must be labeled as of 12:01 a.m.“Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 9, 2021. You will receive a dateconfirmation of your registration by email after we receive your registration materials. Requests for registration should be directed by (i) email to be determinedlegalproxy@computershare.com, with a forward of the email from your broker, or attach an image of your legal proxy or (ii) mail to Computershare, Phio Pharmaceuticals Corp. Legal Proxy, P.O. Box 43001, Providence, Rhode Island 02940-3001.

You may submit questions at the Annual Meeting through any of the following methods:

Prior to the Annual Meeting, by logging on to www.meetingcenter.io/269777998 using the Boardcontrol number included on your Notice, proxy card or on the instructions that accompanied your proxy materials or accessing the site via your email. The password for the meeting is PHIO2021. You can then click on the “Messages” icon on the right-hand side of the page. A pop-up window will appear where you may type your question in the text box. Once done, click “Submit” to submit your question, after which a confirmation message will be specifieddisplayed.

During the Annual Meeting, by accessing the meeting website above using the control number included on your Notice, proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is PHIO2021. You can then submit a live text question by clicking the “Messages” icon on the right-hand side of the page where you may type your question in the Certificate of Amendment (the “Effective Time”). Iftext box by typing in the Board does not decide to implement the Reverse Stock Split within twelve months from the date of the Special Meeting, the authority granted in this proposal to implement the Reverse Stock Split will terminate.“Ask a Question” box.

The Reverse Stock Split will be realized simultaneously for all outstanding Common Stock. The Reverse Stock Split will affect all holders of Common Stock uniformly and each stockholder will hold the same percentage of Common Stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split will not change the par value of our Common Stock and will not reduce the number of authorized shares of Common Stock. The Reverse Stock Split will also affect outstanding options and warrants, as described in “Principal Effects of Reverse Stock Split on Outstanding Equity Awards, Warrants, and Equity Plans” below.

Reasons for the Reverse Stock Split

The principal reason for the Reverse Stock Split is to increase the per share trading price of the Company’s Common Stock in order to help ensure a share price high enough to satisfy the $1.00 per share minimum bid price requirement for continued listing on The Nasdaq Capital Market, although there can be no assurance that the trading price of our Common Stock would be maintained at such level or that we will be able to maintain the listing of our Common Stock on The Nasdaq Capital Market.

As previously reported, on November 2, 2018, the Company received written notice (the “Notification Letter”) from the Nasdaq Stock Market (“Nasdaq”) notifying the Company that it was not in compliance with the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market, because the bid price of the Company’s Common Stock had closed below the minimum $1.00 per share for the 30 consecutive trading days prior to the date of the Notification Letter. The Notification Letter indicated that we were provided an initial period of 180 calendar days, or until May 13, 2019, in which to regain compliance.

This period was extended for a second 180-day period on May 14, 2019. As a result of the extension, we have until November 11, 2019 to regain compliance by maintaining a closing bid price of at least $1.00 per share for a minimum of 10 consecutive trading days. In the event that we do not regain compliance by that date, Nasdaq may commence delisting proceedings and our Common Stock will trade, if at all, on the over-the counter market, such as the OTC Bulletin Board or OTCQX or OTCQB markets, which could adversely impact us by, among other things, reducing the liquidity and market price of our Common Stock; reducing the number of investors willing to hold or acquire our Common Stock; limiting our ability to issue additional securities in the future; and limiting our ability to fund our operations.

If we do not regain compliance by November 11, 2019, we expect that the Nasdaq staff will provide written notice that our Common Stock is subject to delisting. The Board has considered the potential harm to the Company and our stockholders should Nasdaq delist our Common Stock. Delisting from Nasdaq would likely adversely affect our ability to raise additional financing through the public or private sale of equity securities and would significantly affect the ability of investors to trade our securities. Delisting would also likely negatively affect the value and liquidity of our Common Stock because alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets.

| 3 |

Given the volatility and fluctuations in the capital markets, if our share price does not appreciate prior to these deadlines, we believe that the Company’s best option to meet Nasdaq’s $1.00 minimum bid price requirement would be to effect the Reverse Stock Split to increase the per-share trading price of our Common Stock.PROPOSAL NO. 1

In addition, we believe that the low per share market price of our Common Stock impairs its marketability toELECTION OF DIRECTORS

The Amended and acceptance by institutional investors and other membersRestated Bylaws of the investing public and creates a negative impression of the Company. Theoretically, decreasingCompany (the “Bylaws”) provide that the number of shares of Common Stock outstanding shoulddirectors shall be not by itself, affectfewer than two and not more than seven, with directors serving one-year terms. The total Board size is currently fixed at seven directors. Currently, the marketability ofdirectors (whose terms expire at the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. In practice, however, many investors, brokerage firmsAnnual Meeting) are Robert J. Bitterman, Geert Cauwenbergh, Dr. Med. Sc., Gerrit Dispersyn, Dr. Med. Sc., H. Paul Dorman, Robert L. Ferrara, Jonathan E. Freeman, Ph.D. and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the pricing of our Common Stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.Curtis A. Lockshin, Ph.D.

Further, we believe thatAs described below, the Board has nominated Drs. Cauwenbergh, Dispersyn, Freeman and Lockshin and Messrs. Bitterman, Dorman and Ferrara for reelection, as directors at the Annual Meeting. All nominees have indicated their willingness to serve if elected. Directors elected at the Annual Meeting will hold office until the 2022 Annual Meeting of Stockholders and until their successors are elected and qualified, unless they resign or their seats become vacant due to death, removal or other cause in accordance with the Bylaws. Should any nominee become unavailable for election at the Annual Meeting, the persons named on the enclosed proxy as proxy holders may vote all proxies given in response to this solicitation for the election of a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless ofsubstitute nominee chosen by the size of the company’s market capitalization. If the Reverse Stock Split successfully increases the per share price of our common stock, we believe this increase will enhance our ability to attract and retain employees and service providers.Board.

We hope that the decrease in the numberNomination of shares of our outstanding Common Stock as a consequence of the Reverse Stock Split, and the anticipated increase in the price per share, will encourage greater interest in our Common Stock by the financial community, business development partners and the investing public, help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future if needed, and possibly promote greater liquidity for our stockholders with respect to those shares presently held by them. However, the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the Reverse Stock Split is effected, particularly if the price per share of our Common Stock begins a declining trend after the Reverse Stock Split is effected.Directors

The Nominating and Governance Committee reviews and recommends to the Board believes that stockholder adoptionpotential nominees for election to the Board. In reviewing potential nominees, the Nominating and Governance Committee considers the qualifications of a range of reverse stock split ratios (as opposed to adoption of a single reverse stock split ratio or a set of fixed ratios) provides maximum flexibility to achieve the purposes of a reverse stock split and, therefore, iseach potential nominee in the best interestslight of the Company. In determiningBoard’s existing and desired mix of experience and expertise. The Nominating and Governance Committee considers many factors when making a ratio following the receipt of stockholder adoption,determination to nominate a candidate for a director position on the Board, (or any authorized committeesuch as integrity and character, prior business experience, including experience relating to the biotechnology industry, financial literacy and the nominee’s willingness to commit substantial time to the Company. After reviewing the qualifications of potential Board candidates, the Nominating and Governance Committee presents its recommendations to the Board, which selects the final director nominees. Upon the recommendation of the Board) may consider, among other things, factors such as:

Annual Meeting.

The Nominating and Governance Committee considers stockholder nominees using the same criteria set forth above. Stockholders who wish to present a potential nominee to the Nominating and Governance Committee for consideration for election at a future annual meeting of stockholders must provide the Nominating and Governance Committee with notice of the nomination and certain information regarding the candidate within the time periods set forth below under the caption “Stockholder Proposals.”

Although the Nominating and Governance Committee considers whether nominees assist in achieving a mix of Board reserves the rightmembers that represents a diversity of background and experience, including but not limited to elect to abandon the Reverse Stock Split, notwithstanding stockholder adoption thereof, if it determines,race, gender or national origin, we have no formal policy regarding Board diversity. The Nominating and Governance Committee assesses its effectiveness in its sole discretion, that the Reverse Stock Split is no longer needed to regain compliance with Nasdaq’s listing requirements or is no longerachieving these goals in the best interestscourse of assessing director candidates, which is an ongoing process.

Nominees and Incumbent Directors

The Nominating and Governance Committee has recommended and the Board has nominated Drs. Cauwenbergh, Dispersyn, Freeman and Lockshin and Messrs. Bitterman, Dorman and Ferrara to be reelected as directors at the Annual Meeting. The following table sets forth the following information for these nominees: the year each was first elected a director of the Company.Company, if applicable; their respective ages as of the date of filing of this Proxy Statement; the positions currently held with the Company, if any, and the year their current term will expire, if applicable:

Nominee / Director Name and Year First Became a Director | Age | Position(s) with the Company | Year Current Term Expires | |||||||

| Nominees for Directors: | ||||||||||

| Robert J. Bitterman (2012) | 70 | Chairman of the Board of Directors | 2021 | |||||||

| Geert Cauwenbergh, Dr. Med. Sc. (2012) | 67 | Director | 2021 | |||||||

| Gerrit Dispersyn, Dr. Med. Sc. (2020) | 46 | President and Chief Executive Officer | 2021 | |||||||

| H. Paul Dorman (2013) | 84 | Director | 2021 | |||||||

| Robert L. Ferrara (2019) | 70 | Director | 2021 | |||||||

| Jonathan E. Freeman, Ph.D. (2017) | 53 | Director | 2021 | |||||||

| Curtis A. Lockshin, Ph.D. (2013) | 60 | Director | 2021 | |||||||

| 4 |

Reverse Stock Split Amendment to the Charter

If the Reverse Stock Split is approved, subsection(a) of ARTICLE IV of the Charter shall be amended and restated in its entirety as follows:

(a) Authorized Shares. The total number of shares of stock which the Corporation shall have authority to issue is 110,000,000 shares, consisting of 100,000,000 shares of Common Stock, par value $0.0001 per share (“Common Stock”) and 10,000,000 shares of Preferred Stock, par value $0.0001 per share (“Preferred Stock”). Upon the effectiveness of this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation, each [whole number of shares, as determined by the Board], of Common Stock issued and outstanding at such time shall, automatically and without any further action on the part of the Corporation or the holder thereof, be combined into one (1) validly issued, fully paid and non-assessable share of Common Stock (the “Reverse Stock Split”). The par value of the Common Stock following the Reverse Stock Split shall remain $0.0001 per share. No fractional shares shall be issued, and, in lieu thereof, the Corporation shall pay cash equal to such fraction multiplied by the fair market value of a share of Common Stock, as determined by the Board of Directors. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (an “Old Certificate”) shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above.Directors Nominated for Election

The Certificate of Amendment attached hereto as Appendix A reflects the changes that will be implemented to our Charter if the Reverse Stock Split is approved.

Principal Effects of the Reverse Stock Split

If the stockholders approve the proposal to authorize the Board to implement the Reverse Stock Split and the Board implements the Reverse Stock Split, we will amend the existing provision of Article IV of our Charter in the manner set forth above.

By approving this amendment, stockholders will approve the combination of any whole number of shares of Common Stock between and including and , with the exact number to be determined by the Board, into one (1) share. The Certificate of Amendment to be filed with the Secretary of State of the State of Delaware will include only that number determinedfollowing persons have been nominated by the Board to be inelected as directors at the best interests of the Company and its stockholders. In accordance with these resolutions, the Board will not implement any amendment providing for a different split ratio.Annual Meeting.

As explained above, the Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of Common StockRobert J. Bitterman has served as a member and the exchange ratio will be the same for all issued and outstanding shares of Common Stock. The Reverse Stock Split will affect allChairman of our stockholders uniformlyBoard since 2012. Mr. Bitterman served as the President and will not affect any stockholder’s percentage ownership interestsChief Executive Officer of Cutanea Life Sciences, Inc., a private company he founded in 2005 that focused on developing innovative technologies to treat diseases and disorders of the skin and subcutaneous tissue, until its acquisition by Biofrontera, Inc., USA in March 2019. Prior to his role at Cutanea Life Sciences, Inc., Mr. Bitterman also held the position of President and Chief Executive Officer of Isolagen, Inc., President and General Manager of Dermik Laboratories and various positions of increasing responsibility in financial and commercial capacities within Aventis S.A. Mr. Bitterman holds an A.B. degree in Economics from The College of the Holy Cross and a Master of Business Administration degree from Boston University. He also holds a Doctor of Humane Letters (Honoris Causa) from the New York College of Podiatric Medicine. Our Nominating and Governance Committee believes that Mr. Bitterman is qualified to serve as a member of our Board of Directors due to his executive leadership and his experience in the Company, except to the extent that the Reverse Stock Split results in anypharmaceutical industry.

Geert Cauwenbergh, Dr. Med. Sc. has served as a member of our stockholders receivingBoard since April 2012. He served as our President and Chief Executive Officer from April 2012 to November 2018, and as our Chief Executive Officer from November 2018 until his retirement in March 2019. Dr. Cauwenbergh served as Chairman and Chief Executive Officer of RHEI Pharmaceuticals, Inc., a cash paymentprivate company that develops and commercializes proprietary drug therapies, from 2008 to 2011. In 2001, Dr. Cauwenbergh founded Barrier Therapeutics, Inc., a biopharmaceutical company focused on dermatology drug development, until its acquisition by Stiefel Laboratories, Inc. in lieu2008. Prior to Barrier Therapeutics, Inc. Dr. Cauwenbergh was employed by Johnson & Johnson for 23 years where he held a number of owningascending senior management positions. He currently serves as a fractional share,director of Legacy Health Care (Switzerland). Dr. Cauwenbergh received his Doctorate in Medical Sciences from the Catholic University of Leuven, Faculty of Medicine (Belgium), where he also completed his masters and undergraduate work. Our Nominating and Governance Committee believes that Dr. Cauwenbergh is qualified to serve as describeda member of our Board of Directors due to his executive leadership and extensive knowledge and experience in the section titled “Fractional Shares” below. Common Stock issued pursuantbiotechnology industry.

Gerrit Dispersyn, Dr. Med. Sc. has served as a member of our Board since October 2020. He joined the Company in April 2017 as our Chief Development Officer and became our President and Chief Executive Officer in March 2019. From 2014 to April 2017, Dr. Dispersyn was the Reverse Stock Split will remain fully paidVice President, Global Head of Clinical Affairs at Integra LifeSciences Corporation, a world leader in medical technology. Prior to assuming this role, Dr. Dispersyn held the position of Vice President, Program Management & Clinical Affairs from 2008 to 2014. In these positions, Dr. Dispersyn was responsible for the global strategy and non-assessable. The Reverse Stock Split will not affectexecution of clinical and product development, clinical operations and medical affairs projects. He received his Doctorate in Medical Sciences from Maastricht University, Faculty of Medicine (Netherlands), a post-graduate degree in Biomedical Imaging and a Master of Science degree in Biochemistry, both from the Company’s continuing obligations underUniversity of Antwerp, Belgium. Our Nominating and Governance Committee believes that Dr. Dispersyn is qualified to serve as a member of our Board of Directors due to his leadership role as the periodic reporting requirementsPresident and Chief Executive Officer of our Company and his extensive knowledge and experience in the biotechnology industry.

H. Paul Dorman has served as a member of our Board since April 2013. Mr. Dorman currently serves as the Chairman and CEO of DFB Pharmaceuticals, a holdings company specializing in investing in and operating pharmaceutical businesses. From 1990 to 2012, Mr. Dorman also served as the Chairman and CEO of DPT Laboratories, a contract manufacturer and developer of pharmaceutical products. Prior to acquiring DPT, Mr. Dorman was employed by Johnson & Johnson for 12 years, where he served in various positions, including Vice President and as a member of the Securities Exchange Actboard of 1934,directors of several Johnson & Johnson companies. Prior to Johnson & Johnson, Mr. Dorman was employed by Baxter-Travenol, a large pharmaceuticals company. Mr. Dorman holds a B.S. degree in Mechanical Engineering from Tulane University and a Juris Doctor of Law from Loyola University. Our Nominating and Governance Committee believes that Mr. Dorman is qualified to serve as amended (the “Exchange Act”). Followinga member of our Board of Directors due to his executive leadership and business experience in the Reverse Stock Split, our Common Stock will continue to be listed on The Nasdaq Capital Market, under the symbol “PHIO,” although it would receive a new CUSIP number.pharmaceutical industry.

Upon effectivenessRobert L. Ferrara has served as a member of our Board since October 2019. He most recently served as the Chief Financial Officer of Cutanea Life Sciences, Inc., a private company focused on developing innovative technologies to treat diseases and disorders of the Reverse Stock Split,skin and subcutaneous tissue, from January 2012 to June 2019. Prior to Cutanea, Mr. Ferrara served as the numberChief Financial Officer of authorized shares of Common StockStoreroom Solutions Inc., a venture capital financed, technology enhanced, integrated supply chain solutions company, from 2004 to 2011, and NER Data Products, Inc., an IT service management company, from 2000 to 2003, as well as holding other senior level financial positions in national and international public companies in the greater Philadelphia area. Mr. Ferrara received a B.S. in Accounting from Lehigh University and is a Certified Public Accountant. Our Nominating and Governance Committee believes that are not issued or outstanding will increase substantially, because the proposed amendment will not reduce the number of authorized shares, while it will reduce the number of outstanding shares byMr. Ferrara is qualified to serve as a factor of between and including and , depending on the exchange ratio selected by the Board.

The shares that are authorized but unissued after the Reverse Stock Split will be available for issuance, and, if we issue these shares, the ownership interest of holdersmember of our Common Stock may be diluted. We may issue such sharesBoard of Directors due to raisehis financial expertise and his extensive experience in both publicly traded and venture capital and/or as considerationbacked companies in acquiring other businesses or establishing strategic relationships with other companies. Such acquisitions or strategic relationships may be effected using sharesa variety of common stock or other securities convertible into common stock and/or by using capital that may need to be raised by selling such securities. We do not have any agreement, arrangement or understanding at this time with respect to any specific transaction or acquisition for whichindustries, including the newly unissued authorized shares would be issued.life sciences.

| 5 |

ProcedureJonathan E. Freeman, Ph.D. has served has a member of our Board since June 2017. Dr. Freeman currently serves as the Chief Operating Officer of Anthos Therapeutics Inc., a clinical-stage biopharmaceutical company developing therapies for Effecting Reverse Stock Splitcardiovascular patients. Anthos Therapeutics Inc. was launched by Novartis and ExchangeBlackstone Life Sciences, a private investment firm, where Dr. Freeman has also served as a Senior Advisor since July 2018. From 2017 to June 2018, Dr. Freeman held the position of Stock Certificates

IfChief Business Officer of Vedanta Biosciences, a clinical-stage company developing therapies for immune-mediated diseases. Prior to his role with Vedanta Biosciences, Dr. Freeman was the Reverse Stock Split is approved bySenior Vice President of Strategy and Portfolio Management and Head of Business Development and Licensing at Merck KGaA, a leading science and technology company, from 2008 to 2016. Dr. Freeman received a Ph.D. in Molecular Pharmacology and Drug Metabolism from the Company’s stockholders,Imperial Cancer Research Fund (now CRUK), an M.A. and if at such time the Board stillFirst Class Honours in Biochemistry from Cambridge University and a MBA with a finance major from Webster, St. Louis. Our Nominating and Governance Committee believes that Dr. Freeman is qualified to serve as a reverse stock split is in the best interests of the Company and its stockholders, the Board will determine the ratio of the reverse stock split to be implemented. The Reverse Stock Split will become effective as of the Effective Time. The Board will determine the exact timing of the filing of the Certificate of Amendment based on its evaluation as to when the filing would be the most advantageous to the Company and its stockholders. If the Board does not decide to implement the Reverse Stock Split within twelve months from the date of the Special Meeting, the authority granted in this proposal to implement the Reverse Stock Split will terminate.

Except as described below under the section titled “Fractional Shares,” at the Effective Time, each whole number of issued and outstanding pre-Reverse Stock Split shares that the Board has determined will be combined into one post-Reverse Stock Split share, will, automatically and without any further action on the partmember of our stockholders, be combined intoBoard of Directors due to his executive leadership and become one share of Common Stock, and each certificate which, immediately prior to the effective time represented pre-Reverse Stock Split shares, will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares.

Fractional Shares

No fractional shares will be issuedhis background in connection with the Reverse Stock Split. Stockholders of record at the Effective Time of the Reverse Stock Split who otherwise would be entitled to receive fractional shares because they hold a number of pre-Reverse Stock Split shares not evenly divisible by the number of pre-Reverse Stock Split shares for which each post-Reverse Stock Split share is to be exchanged, will, in lieu of a fractional share, be entitled, upon surrender to the exchange agent of certificate(s) representing such pre-Reverse Stock Split shares, to a cash payment in lieu thereof. The cash payment will equal the fraction to which the stockholder would otherwise be entitled multiplied by the average of the closing prices (as adjusted to reflect the Reverse Stock Split) of our Common Stock, as reported by Bloomberg L.P., during the ten consecutive trading days ending on the trading day that is the second day immediately prior to the date on which the Reverse Stock Split becomes effective.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Risks Associated with the Reverse Stock Split

We cannot predict whether the Reverse Stock Split will increase the market price for our Common Stock. Additionally, the market price of our Common Stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. Further, there are a number of risks associated with the Reverse Stock Split, including:

Book-Entry Shares

If the Reverse Stock Split is effected, stockholders who hold uncertificated shares (i.e., shares held in book-entry form and not represented by a physical stock certificate), either as direct or beneficial owners, will have their holdings electronically adjusted automatically by our transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Stock Split. Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from our transfer agent that indicates the number of post-Reverse Stock Split shares of our Common Stock owned in book-entry form.

Certificated Shares

As soon as practicable after the effective time of the Reverse Stock Split, stockholders will be notified that the Reverse Stock Split has been effected. We expect that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-Reverse Stock Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Stock Split shares in exchange for certificates representing post-Reverse Stock Split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us or our exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-Reverse Stock Split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-Reverse Stock Split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Principal Effects of Reverse Stock Split on Outstanding Equity Awards, Warrants, and Equity Plans

As of September 30, 2019, there were:

When the Reverse Stock Split becomes effective, the number of shares of Common Stock covered by such rights will be reduced to between and including and the number currently covered, and the exercise or conversion price per share will be increased to between and including and times the current exercise or conversion price, resulting in the same aggregate price being required to be paid therefor upon exercise or conversion thereof as was required immediately preceding the Reverse Stock Split.

In addition, the number of shares of Common Stock and number of shares of Common Stock subject to stock options or similar rights authorized under the Company’s equity incentive plan and employee stock purchase plan will automatically be proportionately adjusted for the reverse stock split ratio, such that fewer shares will be subject to such plans. Further, the per share exercise price under such plans will automatically be proportionately adjusted for the Reverse Stock Split.

Accounting Matters

The Reverse Stock Split will not affect the common stock capital account on our balance sheet. However, because the par value of our Common Stock will remain unchanged at the effective time of the split, the components that make up the common stock capital account will change by offsetting amounts. Depending on the size of the Reverse Stock Split the Board decides to implement, the stated capital component will be reduced proportionately based upon the Reverse Stock Split and the additional paid-in capital component will be increased with the amount by which the stated capital is reduced. Immediately after the Reverse Stock Split, the per share net income or loss and net book value of our Common Stock will be increased because there will be fewer shares of common stock outstanding. All historic share and per share amounts in our financial statements and related footnotes will be adjusted accordingly for the Reverse Stock Split.

Effect on Par Value

The proposed amendment to our Charter will not affect the par value of our Common Stock, which will remain at $0.0001 per share.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, our Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Potential Anti-Takeover Effect

Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another company), the Reverse Stock Split proposal is not being proposed in response to any effort of which we are aware to accumulate shares of our Common Stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar amendments to the Board and stockholders. Other than the Reverse Stock Split proposal, the Board does not currently contemplate recommending the adoption of any other actions that could be construed to affect the ability of third parties to take over or change control of the Company.

No Dissenters’ Appraisal Rights

Under the Delaware General Corporation Law, the Company’s stockholders are not entitled to dissenters’ appraisal rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such right.

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The following is not intended as tax or legal advice. Each holder should seek advice based on his, her or its particular circumstances from an independent tax advisor.

The following is a summary of certain United States federal income tax consequences of the Reverse Stock Split generally applicable to beneficial holders of shares of our Common Stock. This summary addresses only such stockholders who hold their pre-reverse stock split shares as capital assets and will hold the post-reverse stock split shares as capital assets. This discussion does not address all United States federal income tax considerations that may be relevant to particular stockholders in light of their individual circumstances or to stockholders that are subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Internal Revenue Code of 1986, as amended, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should consult its tax advisor as to the particular facts and circumstances which may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Stock Split.

Exchange Pursuant to Reverse Stock Splitimmunology.

No gain or loss will be recognized byCurtis A. Lockshin, Ph.D. has served as a stockholder upon such stockholder’s exchangemember of pre-reverse stock split shares for post-reverse stock split shares pursuantour Board since April 2013. Dr. Lockshin currently serves as the Chief Scientific Officer of Xenetic Biosciences, Inc., a biopharmaceutical company focused on the development of novel oncology therapeutics. Prior to this appointment, Dr. Lockshin served as Xenetic Biosciences, Inc.’s Vice President of Research and Operations from March 2014 to January 2017. From July 2016 to December 2016, Dr. Lockshin served as Chief Technical Officer of VBI Vaccines, Inc., a company developing vaccines in infectious disease and immuno-oncology. VBI Vaccines, Inc. merged with SciVac Therapeutics, Inc. and its subsidiary SciVac, Ltd., a commercial-stage biologics and vaccine company, in July 2016 where Dr. Lockshin had served as its Chief Executive Officer and director since September 2014. Since May 2013, Dr. Lockshin has also served as President and Chief Executive Officer of Guardum Pharmaceuticals, LLC, a private pharmaceutical company. Dr. Lockshin holds a S.B. degree in Life Sciences and a Ph.D. in Biological Chemistry from the Reverse Stock Split, exceptMassachusetts Institute of Technology. Our Nominating and Governance Committee believes that Dr. Lockshin is qualified to the extentserve as a member of cash, if any, received in lieu of fractional shares, further described in “Cash in Lieu of Fractional Shares” below. The aggregate tax basis of the post-reverse stock split shares received in the Reverse Stock Split, including any fractional share deemed to have been received, will be equal to the aggregate tax basis of the pre-reverse stock split shares exchanged therefor, and the holding period of the post-reverse stock split shares will include the holding period of the pre-reverse stock split shares.

Cash in Lieu of Fractional Shares

A holder of pre-reverse stock split shares that receives cash in lieu of a fractional share of post-reverse stock split shares should generally be treated as having received such fractional share pursuant to the Reverse Stock Split and then as having exchanged such fractional share for cash in a redemption by the Company. The amount of any gain or loss should be equal to the difference between the ratable portion of the tax basis of the pre-reverse stock split shares exchanged in the Reverse Stock Split that is allocated to such fractional share and the cash received in lieu thereof. In general, any such gain or loss will constitute a long-term capital gain or loss if the holder’s holding period for such pre-reverse stock split shares exceeds one year at the time of the Reverse Stock Split. Deductibility of capital losses by holders is subject to limitations.

Interestsour Board of Directors due to his scientific background, his significant industry knowledge and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our Common Stock.

Reservation of Right to Abandon Reverse Stock Split

We reserve the right to not file the Certificate of Amendment and to abandon any Reverse Stock Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Certificate of Amendment, even if the authority to effect these amendments is approved by our stockholders at the Special Meeting. By voting in favor of the Reverse Stock Split, you are expressly also authorizing the Board to delay, not proceed with, and abandon, the Reverse Stock Split and the Certificate of Amendment if it should so decide, in its sole discretion, that such actions are in the best interests of our stockholders.

Recommendation

The Board recommends a vote “FOR” the ratification of the Certificate of Amendment so as to effect the Reverse Stock Split.management experience.

Vote Required

The seven nominees who receive the greatest number of affirmative votevotes of the holders of a majority of the outstanding shares of our Common Stock entitled to vote on the matter either in person orcast will be elected as directors. Any shares that are not voted, whether by proxy is required to approve the Certificate of Amendment to our Charter to effect the Reverse Stock Split of our Common Stock. Abstentions andabstention, broker non-votes if any,(if any) or otherwise, will thus count as votes AGAINSTnot affect the Reverse Stock Split.

election of directors. Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, then FOR the Reverse Stock Split.election of the nominees named in this Proxy Statement.

THE BOARD RECOMMENDS A VOTE “FOR”

THE NOMINEES IDENTIFIED ABOVE.

| 6 |

PROPOSAL NO. 2

RATIFICATION OF DIRECTORSINDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected BDO USA, LLP (“BDO”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021, and has further directed that we submit the selection of BDO for ratification by our stockholders at the Annual Meeting.

The Company is not required to submit the selection of our independent registered public accounting firm for stockholder approval. However, if the stockholders do not ratify this selection, the Audit Committee will reconsider its selection of BDO. Even if the selection is ratified, our Audit Committee may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that the change would be in the best interests of the Company.

The Audit Committee reviews and pre-approves all audit and non-audit services performed by its independent registered public accounting firm, as well as the fees charged for such services. All fees incurred in fiscal years 2020 and 2019 for services rendered by BDO were approved in accordance with these policies. In its review of non-audit service fees, the Audit Committee considers, among other things, the possible impact of the performance of such services on the auditor’s independence. Additional information concerning the Audit Committee and its activities can be found in the “Board Committees” section of this Proxy Statement.

Representatives of BDO are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions.

Fees for Independent Registered Public Accounting Firm

The following is a summary of the fees billed to the Company by BDO for professional services rendered for the fiscal years ended December 31, 2020 and 2019.

| 2020 | 2019 | |||||||

| Audit Fees | $ | 246,494 | $ | 203,865 | ||||

| Audit-Related Fees | – | – | ||||||

| Tax Fees | – | – | ||||||

| All Other Fees | – | – | ||||||

| Total All Fees: | $ | 246,494 | $ | 203,865 | ||||

Audit Fees consist of fees for the audit of the Company’s financial statements included in our annual reports on Form 10-K, the review of the Company’s financial statements included in our quarterly reports on Form 10-Q and other statutory and regulatory filings, including auditor consents.

Audit-Related Fees consist of fees billed for assurance and related services that are also performed by our independent registered public accounting firm.

Tax Fees consist of services rendered for tax compliance, tax advice and tax planning.

Recommendation

The Board recommends a vote “FOR” the ratification of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Proxies will be so voted unless stockholders specify otherwise in their proxies.

Vote Required

Ratification of the selection of the independent registered public accounting firm requires the affirmative vote of a majority of the votes cast on the matter affirmatively or negatively. Abstentions and broker non-votes (if any) will be entirely excluded from the vote and will have no effect on its outcome.

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1.2.

| 7 |

BOARD OF DIRECTORS AND COMMITTEES

During fiscal year 2020, our Board met 11 times. Each director attended at least 71% of the aggregate of the meetings of the Board and meetings of the committees of which he was a member in our last fiscal year. The Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. All members of the Audit, Compensation and Nominating and Governance Committees are non-employee directors who are deemed independent.

Although the Company has no formal policies regarding director attendance at annual meetings, it does expect that all members of the Board will attend the Annual Meeting. All directors attended the 2020 Annual Meeting of Stockholders.

Board Leadership Structure and Role in Risk Oversight

The positions of Chairman of the Board and Chief Executive Officer are separated, which allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. Our Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman. Our Board also believes that this structure ensures a greater role for the independent directors in the oversight of our Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our Board. Our Board believes its administration of its risk oversight function has not affected its leadership structure.

While our Bylaws do not require that our Chairman and Chief Executive Officer positions be separate, our Board believes that having separate positions and having an independent outside director serve as Chairman is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance. Our separated Chairman and Chief Executive Officer positions are augmented by our independent Board committees that provide appropriate oversight in the areas described below. At executive sessions of independent directors, these directors speak candidly on any matter of interest, which may be with or without the Chief Executive Officer present. The independent directors meet separately in executive session on at least an annual basis to discuss matters relating to the Company and the Board, without members of the management team present. We believe this structure provides consistent and effective oversight of our management and the Company. The Board met in executive session one time in 2020.

The Board has overall responsibility for the oversight of the Company’s risk management process, which is designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. Risk management includes not only understanding company-specific risks and the steps management implements to manage those risks, but also what level of risk is acceptable and appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and implementing appropriate risk management practices. The Board periodically reviews our business strategy and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the Company. The Board also delegates oversight to Board committees to oversee selected elements of risk as set forth below.

Board Committees

Audit Committee. As of the Record Date, the Audit Committee was comprised of Messrs. Ferrara (Chairman) and Dorman and Dr. Freeman. The Audit Committee selects the Company’s independent registered public accounting firm, approves its compensation, oversees and evaluates the performance of the independent registered public accounting firm, oversees the accounting and financial reporting policies and internal control systems of the Company, reviews the Company’s interim and annual financial statements, independent registered public accounting firm reports and management letters and performs other duties, as specified in the Audit Committee Charter. All members of the Audit Committee satisfy the current independence and experience requirements of Rule 10A-3 of the Exchange Act and the current Nasdaq independence standards, and the Board has determined that Mr. Ferrara is an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K. The Audit Committee met four times in fiscal year 2020.

| 8 |

Compensation Committee. As of the Record Date, the Compensation Committee was comprised of Messrs. Bitterman (Chairman) and Ferrara and Dr. Lockshin. The Compensation Committee determines compensation levels for the Company’s executive officers and directors, oversees administration of the Company’s equity compensation plans and performs other duties regarding compensation for employees and consultants as the Board may delegate from time to time. Our Chief Executive Officer makes recommendations to the Compensation Committee regarding the corporate and individual performance goals and objectives relevant to executive compensation and executives’ performance in light of such goals and objectives and recommends other executives’ compensation levels to the Compensation Committee based on such evaluations. The Compensation Committee considers these recommendations and then makes an independent decision regarding officer compensation levels and awards. All members of the Compensation Committee satisfy the current Nasdaq independence standards, and each member of the Committee qualifies as an “outside director” and “non-employee director” as defined by Section 162(m) of the Code and Rule 16b-3 of the Exchange Act, respectively. The Compensation Committee met one time in fiscal year 2020.

Nominating and Governance Committee. As of the Record Date, the Nominating and Governance Committee was comprised of Drs. Lockshin (Chairman) and Freeman and Messr. Dorman. The Nominating and Governance Committee reviews potential director nominees, recommends nominees to the Board, oversees the Company’s corporate governance principles and develops and implements policies and processes regarding corporate governance matters. Drs. Lockshin and Freeman and Messr. Dorman satisfy the current Nasdaq independence standards. The Nominating and Governance Committee met two times in fiscal year 2020.

A copy of the Company’s Audit, Compensation and Nominating and Governance Committee charters are available on the Company’s website at www.phiopharma.com.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

Our Board has a policy to review and approve all transactions with directors, officers and holders of more than 5% of our voting securities and their affiliates. The policy provides that, prior to Board consideration of a transaction with such a related party, the material facts as to the related party’s relationship or interest in the transaction must be disclosed to the Board, and the transaction will not be considered approved by the Board unless a majority of the directors who are not interested in the transaction (if applicable) approve the transaction. Furthermore, when stockholders are entitled to vote on a transaction with a related party, the material facts of the related party’s relationship or interest in the transaction must be disclosed to the stockholders, who must approve the transaction in good faith.

In March 2019, the Company entered into a consulting agreement with Dr. Cauwenbergh, one of our directors, which was renewed for another one-year term in March 2020. The Company paid Dr. Cauwenbergh $90,393 in consulting fees in 2019. No consulting fees were paid to Dr. Cauwenbergh in 2020. Outside of the Company’s consulting agreement with Dr. Cauwenbergh, since the past two years, there has not been, nor is there currently proposed, any transaction or series of related transactions to which we were or will be a party in which the amount involved exceeded or will exceed $120,000 and in which the other parties included or will include any of our directors, executive officers, holders of 5% or more of our voting securities, or any member of the immediate family of any of the foregoing persons, other than compensation arrangements with directors and executive officers, which are described where required in “Executive Compensation” and “Director Compensation.”

Indemnification Agreements

We have entered into indemnification agreements with each of our executive officers and directors. These agreements provide that, subject to limited exceptions and among other things, we will indemnify each of our executive officers and directors to the fullest extent permitted by law and advance expenses to each indemnitee in connection with any proceeding in which a right to indemnification is available.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our “officers” (as defined in Rule 16a-1(f) under the Exchange Act) and directors, and persons who own more than 10% of a registered class of our equity securities to file reports of beneficial ownership and changes in beneficial ownership with the SEC. Officers, directors and greater-than-10% stockholders (the “Reporting Persons”) are required by SEC regulations to furnish us with copies of all reports filed under Section 16(a). Based solely on our review of copies of these reports and representations of such Reporting Persons, we believe that during fiscal year 2020, all Reporting Persons satisfied such applicable SEC filing requirements.

| 9 |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information, as of December 31, 2020, about the securities authorized for issuance under our equity compensation plans, which consisted of our 2020 Long Term Incentive Plan (“2020 Plan”) and our 2013 Employee Stock Purchase Plan. Upon adoption of the 2020 Plan, shares that remained available for grant under our prior 2012 Long Term Incentive Plan (“2012 Plan”) and shares that were subject to outstanding awards under the 2012 Plan were included in the authorized shares available for grant under the 2020 Plan. Further, upon adoption of the 2020 Plan, the Company no longer grants new equity awards under the 2012 Plan.

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in First Column) | |||||||||

| Equity compensation plans approved by security holders(1) | 12,269 | $ | 3,334.06 | 1,262,836 | ||||||||

| Equity compensation plans not approved by security holders | – | – | – | |||||||||

| Total | 12,269 | $ | 3,334.06 | 1,262,836 | ||||||||

___________________

| (1) | Includes options outstanding representing 2,570 shares of common stock under the 2020 Plan. Also includes 9,699 restricted stock units subject to the 2020 Plan. |

| 10 |

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Based on information available to us and filings with the SEC, the following table sets forth certain information regarding the beneficial ownership (as defined by Rule 13d-3 under the Exchange Act) of our outstanding common stock for (i) each of our current directors, (ii) each of our “named executive officers,” as defined in the Executive Officers section above,below, (iii) all of our current directors and executive officers as a group and (iv) persons known to us to beneficially own more than 5% of our outstanding common stock. The following information for such persons is presented as of September 30, 2019March 15, 2021 or such other date as may be reflected below.

Beneficial ownership and percentage ownership are determined in accordance with the rules of the SEC and include voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, shares of common stock issuable throughnot outstanding but deemed beneficially owned by virtue of the exerciseright of any option, warranta person to acquire them as of March 15, 2021, or right within 60 days of September 30, 2019March 15, 2021, are deemed outstanding for the purpose of computing the percentage ownership of theeach person, holding the option, warrant or right, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over their shares of common stock, except for those jointly owned with that person’s spouse. Unless otherwise indicated below, the address of each person listed on the table is c/o Phio Pharmaceuticals Corp., 257 Simarano Drive, Suite 101, Marlborough, MA 01752.

| Shares Beneficially Owned | ||||||||

| Name and Address of Beneficial Owner | Number (1) | Percent of Class(2) | ||||||

| Greater than 5% Holders | ||||||||

CVI Investments, Inc.(3) P.O. Box 309GT Ugland House South Church Street George Town, Grand Cayman KY1-1104 Cayman Islands | 1,998,801 | 7.79% | ||||||

Sabby Volatility Warrant Master Fund, Ltd.(4) c/o Ogier Fiduciary Services (Cayman) Limited 89 Nexus Way, Camana Bay Grand Cayman KY1-9007 Cayman Islands | 1,814,619 | 7.07% | ||||||

| Directors and Named Executive Officers: | ||||||||

| Gerrit Dispersyn, Dr. Med. Sc.(5) | 13,250 | * | ||||||

| Robert J. Bitterman(6) | 11,830 | * | ||||||

| Geert Cauwenbergh, Dr. Med. Sc.(7) | 491,049 | 1.91% | ||||||

| H. Paul Dorman(8) | 11,598 | * | ||||||

| Robert L. Ferrara | – | * | ||||||

| Jonathan E. Freeman, Ph.D.(9) | 10,350 | * | ||||||

| Curtis A. Lockshin, Ph.D.(10) | 11,225 | * | ||||||

| All current directors and executive officers as a group (seven persons) | 549,302 | 2.14% | ||||||

| Shares Beneficially Owned | |||||||

| Name and Address of Beneficial Owner | Number (1) | Percent of Class(2) | |||||

| Greater than 5% Holders | |||||||

| Empery Asset Management, LP(3) | 899,684 | 6.65% | |||||

| Directors and Named Executive Officers: | |||||||

| Gerrit Dispersyn, Dr. Med. Sc.(4) | 16,796 | * | |||||

| Robert J. Bitterman (5) | 5,848 | * | |||||

| Geert Cauwenbergh, Dr. Med. Sc.(6) | 13,219 | * | |||||

| H. Paul Dorman(7) | 389 | * | |||||

| Robert Ferrara | 3,000 | * | |||||

| Jonathan E. Freeman, Ph.D. (8) | 370 | * | |||||

| Curtis A. Lockshin, Ph.D. (9) | 385 | * | |||||

| All current directors and executive officers as a group (seven persons) | 40,007 | * | |||||

_______________

| * | Indicates less than 1%. |

| (1) | Represents shares of common stock held as of |

| (2) | Based on |

| (3) | Based solely on information set forth in a Schedule 13G filed with the SEC on February |

| (4) | |

| (5) | Includes |

| (6) | Includes |

| (7) | Includes |

| (8) | Includes |

| (9) | Includes |

EXECUTIVE OFFICERS

As of the date of this proxy statement, we have only one executive officer, Gerrit Dispersyn, who serves as our President and Chief Executive Officer. Certain biographical information regarding Dr. Dispersyn is set forth below.

| Name | Age | Position | ||||

| Gerrit Dispersyn, Dr. Med. Sc. | 46 | President and Chief Executive Officer | ||||

Gerrit Dispersyn, Dr. Med. Sc. joined the Company in April 2017 as our Chief Development Officer and became our President and Chief Executive Officer in March 2019. From 2014 to April 2017, Dr. Dispersyn was the Vice President, Global Head of Clinical Affairs at Integra LifeSciences Corporation, a world leader in medical technology. Prior to assuming this role, Dr. Dispersyn held the position of Vice President, Program Management & Clinical Affairs from 2008 to 2014. In these positions, Dr. Dispersyn was responsible for the global strategy and execution of clinical and product development, clinical operations and medical affairs projects. Dr. Dispersyn has also served as a member of our Board since October 2020. He received his Doctorate in Medical Sciences from Maastricht University, Faculty of Medicine (Netherlands), a post-graduate degree in Biomedical Imaging and a Master of Science degree in Biochemistry, both from the University of Antwerp, Belgium.

EXECUTIVE COMPENSATION

The following describes the compensation earned by each of the executive officers identified below in the Summary Compensation Table, who are referred to collectively as our “named executive officers.” Our named executive officer with respect to the fiscal year that ended on December 31, 2020 is Gerrit Dispersyn, Dr. Med. Sc.

| Name and principal position | Year | Salary ($) | Option awards ($)(1) | Stock awards ($)(1) | Non-equity incentive plan compensation ($)(2) | All other compensation ($)(3) | Total ($) | |||||||||||||||||||||

| Gerrit Dispersyn, Dr. Med. Sc. (4) | 2020 | 386,614 | – | – | 196,000 | 528 | 583,142 | |||||||||||||||||||||

| President and Chief Executive Officer | 2019 | 372,251 | – | 117,662 | 168,935 | 534 | 659,382 | |||||||||||||||||||||

(1) | The amounts shown reflect the grant date fair value of stock options and restricted stock units computed in accordance with ASC 718 for the indicated year. |

| (2) | The amounts shown reflect the annual cash bonus earned for performance for each respective year under the Company’s Incentive Bonus Program. The annual cash bonus for fiscal year 2020 was paid in March 2021 and the annual cash bonus for fiscal year 2019 was paid in March 2020. In 2019, Dr. Dispersyn also received a retention bonus. |

| (3) | Represents amounts for the dollar value of life insurance premiums paid. |